When business leaders find themselves asking the difficult questions and making the decisions of whether to cut staff to protect their company’s long-term viability, the CARES Act is to the rescue.

“As cities and states across the nation implement business closures and “shelter in place” mandates for coronavirus, countless small businesses are facing an unthinkable reality: They can’t afford to pay their staff until they’re allowed to reopen their doors..”

– U.S. Chamber of Commerce

The Coronavirus Aid, Relief and Economic Security (CARES) Act is a newly released relief plan – as of March 2020 – for the benefit of individuals and small businesses who will suffer financially during this pandemic for reasons outside of their control.

According to Forbes, “It’s an estimated $2 trillion package, which specifically allots $10 Billion for EIDLs and $350 billion for Paycheck Protection Loads to help small businesses.” EIDLs are Economic Injury Disaster Loans and at the front line of support. The Paycheck Protection Program Loan Guarantee is offered to small businesses with less than 500 employees. For frequently asked questions about the Cares Act visit The U.S. Committee on Financial Services.

You may be asking yourself, what should I do now?

Go to the SBA website and apply directly to either or both loans. According to Forbes, there is no obligation to take the loan, but it’s nice to secure it in case you need it.

“If your business is forced to shut down entirely, it may be inevitable that you need to lay off your entire

If the inevitable decisions are to be made, this is a summary of the U.S Chamber of Commerce recommendations that will help to make the circumstances better…

- Have a plan: a plan might include shorter work weeks. This helps lessen the financial burden on employees and keeps morale up while dealing with the looming need to downsize.

- Be transparent: Being open and honest about the hard decisions the company is facing is crucial for building trust and easing fears. It earns the brand mega brownie points as well.

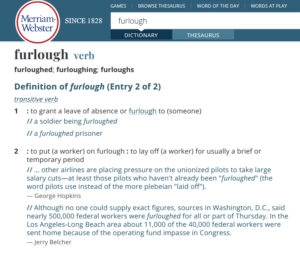

- Clarify benefits: Be clear about how the current furlough or current situation impacts the employee’s benefits.

- Insist on ‘no work’ during furlough: help the company avoid legal claims for unpaid work.

- Provide support: it is natural for employees to have anxiety and fear during this uncertain time. Provide the emotional and mental health support resources that you have available through HR.

- Stay in touch: making sure that employees feel respected and that they still matter and are important to the company is important. Staying in touch can help to alleviate any doubts about the company and the current situation.

The U.S. Chamber of Commerce offers these additional resources:

- Check out the U.S. Chamber’s Small Business Loan Guide.

- To help you manage your business through the coronavirus crisis, the U.S. Chamber of Commerce has created a toolkit for businesses and a customizable flyer for businesses to communicate their coronavirus efforts to customers.

- For more information pertaining to your specific location, you can find your local Chamber of Commerce here.

If you need immediate help, give us a call at (844) 646-4473 or schedule a free consultation

Join Our Webinar - 4 Things to Consider Before Laying Off Your Workforce that can Help Save Your Business

Save Your Business and Help Your Employees Navigate Furlough or Layoffs with Compassion

In the webinar you will learn...

- How to earn your employees' trust and protect your employer reputation

- How to keep your furloughed employees engaged during the COVID-19 Crisis

- How to compassionately save your business and your employees

- How to get your employees back to work quicker after things go back to normal

Leave A Comment